flow-through entity tax form

What form to file. The MI flow-through entity tax is retroactive to Jan.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Foreign tax identification number if any.

. Learn more about pass-through entities including registration and withholding information. The California pass-through entity tax CA PTET also known as the Small Business Relief Act is effective for taxable years beginning on or after January 1 2021 and will sunset on December 31 2025 or January 1 of the tax year after any repeal of Internal Revenue Code Section 164b6. Tax Guide for Pass-Through Entities.

Intermediary or flow-through entitys GIIN. For tax years beginning in 2021 flow-through entities must make this election by April 15 2022. FORM 511 SCHEDULE B PASS-THROUGH ENTITY ELECTION INCOME TAX RETURN MEMBERS INFORMATION COMRAD-0691 NAME FEIN 2020 PART III PASS-THROUGH ENTITY MEMBERS INFORMATION INCLUDING S CORPORATIONS Enter the information in Federal Employer Identification Number order.

2531 which allows partnerships other than a publicly traded partnership and S corporations to elect to pay a 495 entity level state tax on income. Branches for United States tax withholding Online Title Form W-8IMY certificate of foreign intermediary foreign flow-through entity or certain US. In addition other payments made by flow-through entities eg for composite return estimated payments or members eg for MI-1040 estimated payments will not be applied toward the flow-through entity tax and will not constitute an election into the tax.

If the entity does not have a Business Online Services account the authorized person will need to create one. For tax years beginning in 2021 flow-through entities have until April 15 2022 to make this election which will be irrevocable for the next two tax years. It is not a replacement for the regulation and for greater detail please refer to the regulation.

A flow-through entity which does not include an entity that files federally as a C-corporation currently has no return filing requirements for Michigan income tax. Branches for United States tax withholding electronic resource. Form W-8IMY certificate of foreign intermediary foreign flow-through entity or certain US.

Massachusetts joins several other states in enacting an entity-level excise that responds to the SALT cap. For tax years beginning on or after January 1 2021 an authorized person can opt in to PTET on behalf of an eligible entity through the entitys Business Online Services account now through October 15 2021. We are developing the following tax forms for qualified entities to make the PTE elective tax payments and for qualified taxpayers to claim the tax credit.

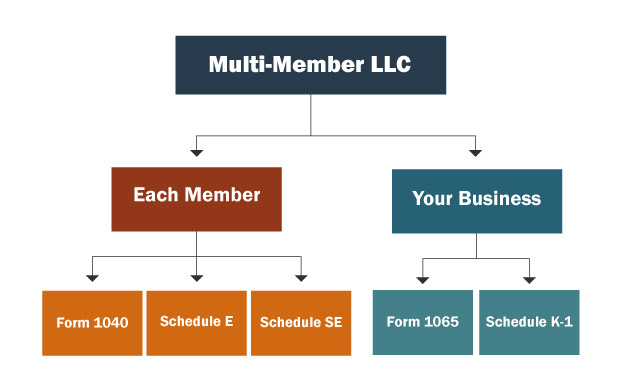

Intermediary or flow-through entitys name. Each pass-through entity owner reports and pays tax on their share of business income on personal tax Form 1040. The flow-through entity tax will be imposed on the entitys allocated or apportioned positive business income tax base at the same rate as the individual income tax currently 425.

This guide will help taxpayers comply with the rules in regulation 830 CMR 62B22. Pass-Through Entity Elective Tax Calculation FTB 3804 Available January 2022. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity.

Pass-Through Entity Elective Tax Payment Voucher FTB 3893 Available November 1 2021. A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax. On September 30 2021 the Massachusetts Legislature adopted an elective pass-through entity PTE excise in response to the 10000 cap on the federal state and local tax SALT deduction added in the 2017 federal Tax Cuts and Jobs Act.

Once this election is made it cannot be revoked for the. Shareholdersmembers of such pass-through entities can then claim a credit on their Michigan individual income tax returns for their share of Michigan income taxes paid at the entity level. The partnership can file a group return but the PTE elective tax credit cannot be claimed on a group return because it is not a flow-through item from the entity.

The PTE elective tax credit is available only on the individual return of the qualified taxpayer. Through entity tax election. The information in this section also applies if for the 1994 tax year you filed Form.

On May 30 2021 the Illinois Legislature approved Senate Bill 2531 SB. Fourth quarter estimated tax payment for calendar year flow-through entities electing into the tax are due Jan. Nonresident members of a flow-through entity may elect to have the flow-through entity file a composite return in lieu.

Every profit-making business other than a C corporation is a flow-through. Federal Employer Identification Number and name of Pass. 1 2021 for certain electing flow-through entities and those entities may be required to pay quarterly estimated tax payments.

The majority of businesses are pass-through entities. Common Types of Pass-Through Entities. An owners income tax.

For tax years beginning on or after January 1 2021 resident partners members or shareholders will be allowed a resident tax credit against their New York State personal income tax for any pass-through entity tax imposed by another state local government or the District of Columbia that is substantially similar to the PTET imposed under Article 24-A. A flow-through entity is not required to file Form 807. Intermediary or flow-through entitys EIN if any.

What Is A Pass Through Entity Definition Meaning Example

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Pass Through Taxation What Small Business Owners Need To Know

A Beginner S Guide To Pass Through Entities The Blueprint

Multi Member Llc Taxes Llc Partnership Taxes

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

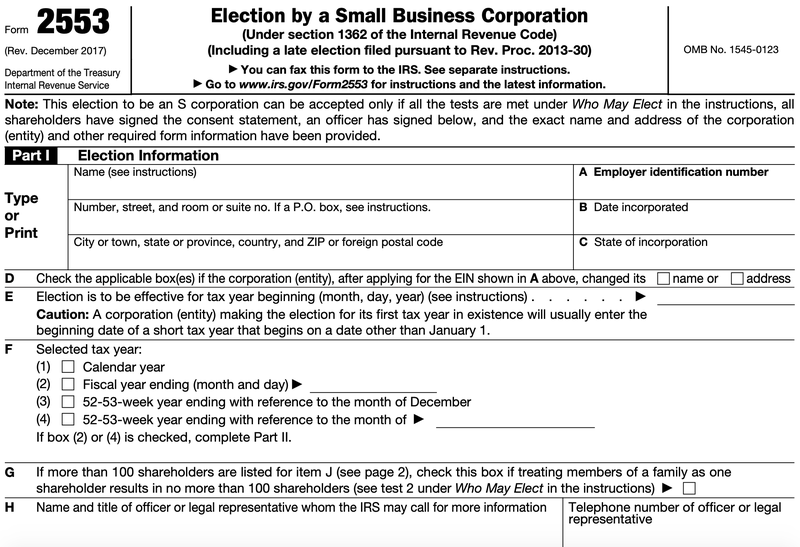

A Beginner S Guide To S Corporation Taxes The Blueprint

Instructions For Form 8995 2021 Internal Revenue Service

Pass Through Entity Definition Examples Advantages Disadvantages